Rich Dad Poor Dad Chapter Summaries

Avoiding failure leads to an unsuccessful life

Why We Recommend this Book

Rich Dad Poor Dad by Robert Kiyosaki is a financial mindset shift that has transformed the way millions of people think about money, wealth, and success.

Thousands of people have credited this book with helping them:

- Start investing in real estate or stocks

- Build passive income streams

- Escape paycheck-to-paycheck living

- Develop an entrepreneurial mindset

Rich Dad Poor Dad

Rich Dad Poor Dad Chapter Summaries

Imagine this: what if a few simple changes in how you think about money could completely transform your future?

That’s the promise of Rich Dad Poor Dad. This book is a wake-up call for anyone stuck in the paycheck-to-paycheck cycle or worried they’ll never get ahead financially.

But we know your time is precious, and diving into a full book can feel overwhelming. So, we created this summary—to give you the powerful lessons and insights in just a fraction of the time.

And trust us, once you see what’s inside, you’ll want the full book to dig even deeper.

Introduction

What if everything you thought you knew about money was wrong?

Rich Dad Poor Dad by Robert Kiyosaki challenges everything society has taught us about wealth. It’s not a story about being born rich or lucky—it’s about learning the secrets of money that schools don’t teach.

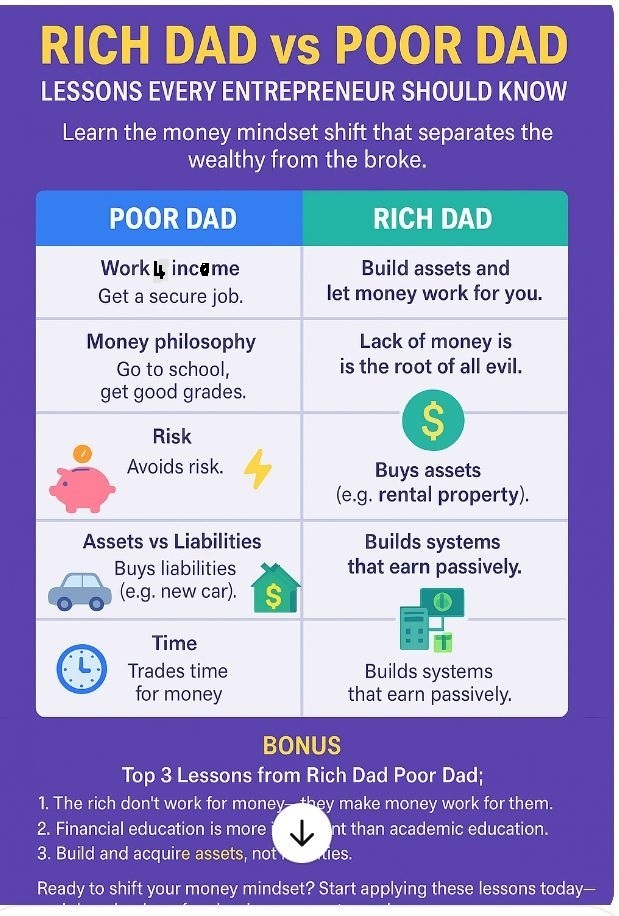

Through the contrasting lessons of two father figures—his highly educated but financially struggling biological dad (Poor Dad) and his wealthy, street-smart mentor (Rich Dad)—Kiyosaki reveals the principles that can transform anyone’s financial future.

Is Rich Dad Poor Dad worth reading? I will say a big YES!

This book doesn’t just teach you how to make money—it reshapes how you think about money.

From the power of assets over liabilities to the importance of financial education, Kiyosaki provides actionable insights that anyone can use to escape the rat race and achieve financial freedom.

If you’re tired of living paycheck to paycheck or want to break free from the 9-to-5 grind, this is a must-read. Stay with me to uncover the key lessons from Rich Dad Poor Dad—lessons that could change your life forever.

If you don’t have this book yet, get it here on Amazon or listen to Rich Dad Poor Dad audiobook for free with Audible.

Click on the Tabs Below to Read Rich Dad Poor Dad Summary

Rich Dad Poor Dad review in one sentence:

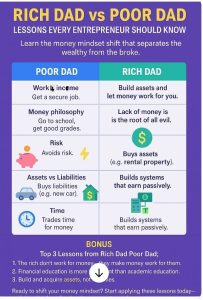

This book teaches the importance of financial education, highlighting the difference between working for money and having money work for you by building assets and thinking like an investor.

Who Should Read Rich Dad Poor Dad?

- Aspiring Entrepreneurs: It provides a clear framework for thinking like a business owner and creating wealth.

- Employees Seeking Financial Independence: Learn how to move beyond the paycheck-to-paycheck mindset and build lasting financial security.

- Parents: Gain insights into teaching children about money, helping them develop financial literacy early.

- Anyone Struggling with Finances: Discover practical advice on breaking free from debt and poor spending habits.

Why Should you Read It?

Learn the Difference Between Assets and Liabilities: Most people confuse the two, and this book clears it up with relatable examples.

Develop a Growth Mindset: It challenges traditional beliefs about work, money, and education.

Practical Tips for Building Wealth: Offers actionable advice on investing, real estate, and creating passive income.

Inspiring Stories: The contrasting philosophies of the “rich dad” and “poor dad” make the lessons engaging and memorable.

Reading Rich Dad Poor Dad is an essential step for anyone looking to achieve financial freedom and live life on their terms.

Introduction: The Rich Don’t Work for Money

Robert shares his story of growing up with two father figures: his biological father (Poor Dad), who was highly educated but struggled financially, and his best friend’s father (Rich Dad), a self-made millionaire.

The central lesson:

Poor Dad believed in working hard for money, getting a stable job, and saving for retirement.

Rich Dad believed in making money work for you by investing in assets and building wealth.

Kiyosaki introduces the idea that financial education is critical and that schools fail to teach it.

Chapter 1: The Rich Don’t Work for Money

This chapter introduces a key concept: stop working solely for a paycheck.

Young Robert and his friend Mike worked for Rich Dad, who paid them a meager amount. They learned that chasing higher wages keeps people trapped in the “rat race.”

Rich Dad taught them to look for opportunities to make money outside traditional jobs, like spotting problems and creating solutions.

Example: Robert noticed unused comic books in Rich Dad’s store. He created a small library for kids, charging 10 cents for admission, and split profits with Mike.

Chapter 2: Why Teach Financial Literacy?

The big lesson here: It’s not about how much money you make but how much you keep.

Assets put money in your pocket, while liabilities take money out.

Many people think their house is an asset, but if it doesn’t generate income, it’s a liability.

Kiyosaki explains the importance of building assets like real estate, stocks, or businesses instead of focusing on acquiring liabilities (like luxury cars bought on credit).

Chapter 3: Mind Your Own Business

Lesson: Start building your asset column, even if you work a 9-to-5 job.

Rich Dad emphasized that working for others makes the employer richer, not you.

Kiyosaki advises readers to keep their day job but focus on building investments and side businesses on the side.

Example: Instead of buying luxuries upfront, invest in assets that generate income. Use that income to buy luxuries later.

Chapter 4: The History of Taxes and the Power of Corporations

Kiyosaki explains how the wealthy use corporations and tax laws to their advantage.

The poor and middle class earn money, pay taxes, and spend what’s left.

The rich earn money, spend on business expenses, and pay taxes on what’s left.

Key point: Learn how taxes work and use legal loopholes like creating a corporation to reduce your tax burden.

Chapter 5: The Rich Invent Money

This chapter focuses on creating opportunities rather than waiting for them.

Rich Dad taught Robert that courage, creativity, and financial knowledge help you spot investments others overlook.

Most people avoid risks, but the rich take calculated risks and learn from failures.

Example: Kiyosaki and his wife bought run-down properties, fixed them up, and rented them out for passive income.

Chapter 6: Work to Learn—Don’t Work for Money

Lesson: Focus on skills, not just paychecks.

Poor Dad encouraged Robert to specialize in one field, but Rich Dad advised him to learn multiple skills.

Working in different jobs teaches you sales, marketing, management, and leadership, which are crucial for entrepreneurship.

Kiyosaki himself worked as a salesman for Xerox to master sales skills before launching his own business.

Chapter 7: Overcoming Obstacles

The biggest barriers to wealth are fear, cynicism, laziness, bad habits, and arrogance.

Fear: Many people don’t invest because they’re afraid of losing money. Kiyosaki advises embracing failure as a learning opportunity.

Cynicism: Don’t let doubts or others’ opinions stop you from taking action.

Laziness: Avoid using “I’m too busy” as an excuse to neglect building wealth.

Example: Rich Dad taught Robert to face his fears of losing money by starting small, learning, and growing his investments over time.

Chapter 8: Getting Started

This chapter gives actionable advice:

- Set clear goals. Decide why you want to achieve financial freedom.

- Choose your friends carefully. Surround yourself with people who challenge and inspire you.

- Learn to manage risks. Study investing and take calculated risks.

- Take action. Don’t overanalyze; start small but start now.

Kiyosaki emphasizes the importance of continuous learning and suggests reading books, attending seminars, and finding mentors.

Chapter 9: Still Want More? Here Are Some To-Do’s

Kiyosaki ends the book with practical steps:

Start building your financial IQ by understanding accounting, investing, markets, and law.

Keep your expenses low and invest the difference in assets.

Pay yourself first: Save and invest before paying bills or buying luxuries.

Example: He suggests finding a real estate deal or starting a small business to practice applying what you’ve learnt.

Final Thoughts

Rich Dad Poor Dad challenges conventional wisdom about money and teaches readers to rethink how they approach work, saving, and investing. The core takeaway is simple: focus on financial education, build assets, and let your money work for you.

Here are the things you need to start doing right now:

1. Track Your Financial Situation

Action: Write down all your income sources, expenses, assets, and liabilities.

How to Do It:

Use a spreadsheet or a budgeting app like Mint or YNAB.

Identify where your money is going and which items are liabilities (e.g., loans, car payments).

Highlight areas where you can cut unnecessary expenses.

2. Start Building an Emergency Fund

Action: Save at least 3–6 months’ worth of living expenses.

How to Do It:

Set up a separate savings account.

Automate a portion of your paycheck to go directly into savings.

Begin with small, consistent contributions.

3. Begin Building Your Asset Column

Action: Start investing in assets that generate passive income.

How to Do It:

Research low-cost index funds or REITs (Real Estate Investment Trusts).

Start small with platforms like Robinhood or Acorns if you’re a beginner.

Consider investing in real estate by exploring rental properties or crowdfunding platforms.

4. Pay Yourself First

Action: Set aside a portion of your income for investments and savings before paying bills or spending.

How to Do It:

Allocate at least 10% of your monthly income toward savings or investment accounts.

Treat this as a non-negotiable expense, just like rent or utilities.

5. Learn Financial Literacy

Action: Commit to learning the basics of money management and investing.

How to Do It:

Read books like The Intelligent Investor by Benjamin Graham or The Richest Man in Babylon.

Follow financial podcasts or YouTube channels for actionable advice.

Take online courses on budgeting, investing, or real estate.

6. Start a Side Hustle

Action: Explore ways to generate additional income outside your primary job.

How to Do It:

Identify your skills or hobbies that could be monetized (e.g., freelance writing, tutoring, or graphic design).

Use platforms like Fiverr, Upwork, or Etsy to market your services or products.

Dedicate a few hours weekly to building and growing this side business.

7. Practice Delayed Gratification

Action: Avoid impulsive purchases and focus on long-term financial goals.

How to Do It:

Before making a purchase, ask yourself if it’s a need or a want.

Set a “cool-off” period for big expenses to ensure they align with your goals.

Use the extra money saved to invest or pay down debt.

8. Network with Like-Minded People

Action: Surround yourself with people who understand and support your financial goals.

How to Do It:

Attend local or online meetups for entrepreneurs and investors.

Join communities like BiggerPockets (for real estate) or personal finance forums.

Seek out a mentor who can guide you in building wealth.

9. Set Specific Financial Goals

Action: Write down clear, measurable financial goals for the short and long term.

How to Do It:

Example: “Save $10,000 for investment within one year.”

Break your goal into smaller monthly targets.

Regularly review your progress and adjust your strategy as needed.

10. Start Taking Calculated Risks

Action: Step outside your comfort zone and explore new investment opportunities.

How to Do It:

Begin by investing small amounts in areas like stocks, ETFs, or cryptocurrency.

Research extensively and diversify your investments to minimize risk.

Accept that mistakes are part of the learning process and focus on long-term growth.

Final Note:

These steps don’t require perfection; they require commitment. Start small, be consistent, and learn as you go. Building wealth is a journey, and taking action now is the most critical step to financial freedom!

Here are books similar to From Zero to One:

The Power of Concentration by Theron Q. Dumont

Think and Grow Rich by Napoleon Hill

The Empire of Business by Andrew Carnegie

Download Rich Dad Poor Dad Summary PDF

Robert T. Kiyosaki is an entrepreneur, investor, motivational speaker, and financial educator best known for his Rich Dad series of books.

Born on April 8, 1947, in Hilo, Hawaii, Robert served in the U.S. Marine Corps before becoming a businessman.

His financial philosophy centres on teaching others how to achieve financial independence through investing, entrepreneurship, and financial literacy.

With over 20 years of experience teaching millions worldwide, Kiyosaki has become a trusted voice in personal finance.

Book Details

Title: Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Genre: Personal Finance, Business, Self-Help

Format: Paperback, eBook, Audiobook

Publication Date: First published in April 1997

Number of Pages: 336 (varies slightly by edition)

Course Curriculum

Test Your Knowledge of Rich Dad Poor Dad

-

Start Rich Dad Poor Dad Quiz

Evunn Concept

Rich Dad Poor Dad and The Richest Man in Babylon by George S. Clason share a common concept:

Financial freedom comes from not just earning more money but learning how to manage, save, and invest it wisely, so your money works for you instead of you constantly working for money.

Your Next Read